Financial literacy is having skills and knowledge that allow an individual to make thorough and productive decisions with all of their financial resources. Understanding basic financial concepts allows us to know how to operate in a financial system. People with relevant financial literacy training make better financial decisions and tempt to manage money better than those without such training.

Financial literacy is the assured understanding of saving, investing, and debts that lead to an overall sense of financial well-being and self-trust. It starts by building basic awareness of money matters. Some of the main concerned points are saving money, budgeting, smart spending, managing debt, utilizing credit, increasing investments, and financial security.

When it comes to personal context, Financial literacy or knowledge has a significant impact on families as they try to make a balance with their budget, buy a home, fund their children’s education, and ensure an income for their retirement.

Being aware of these concepts is beneficial in various ways if we consider each and every age group. Without achieving financial literacy we can’t improve ourselves in our personal lives and as a whole, we can’t go forward as a country. Before trying to put in facts to give an understanding of what financial literacy is, it is better to give an idea about the benefits as it’s more efficient for understanding and also to grab the attention of people to focus on financial literacy.

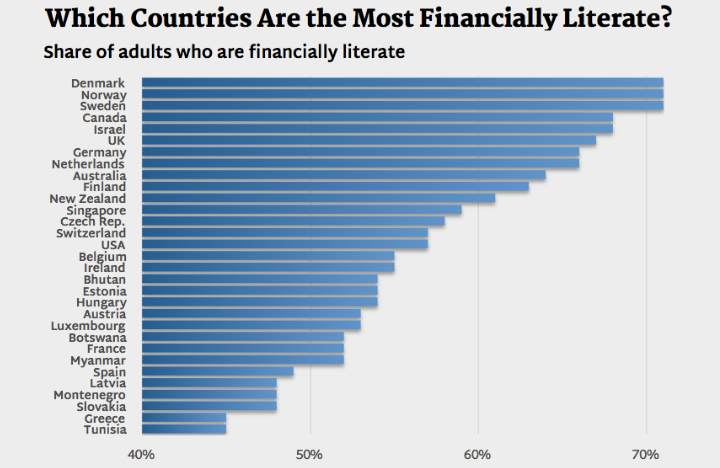

Based on the definition of financial literacy 33% of adults worldwide are financially literate. This means that around 3.5 billion adults globally, most of them in developing economies lack an understanding of basic financial concepts.

As college or university students financial literacy is important because the formula for college success today only has two factors: grades and money. Professors and instructors thoroughly educate students on academic requirements and grading policies. Financial literacy is important as it’s one of the things that will encompass just about every aspect of a person’s life. Being aware of your financial status and your possibilities to grow your earnings, allows an individual to understand and maximize whatever level of income they earn. It helps people transform their lives.

Understanding your finances seeps into every area of your life.

South Asia is recording the lowest percentage of financial literacy, with Sri Lanka coming in at about 35%.

So it is a concurrent requirement to develop financial literacy among folks. A few simple steps you can follow in order to improve your financial literacy skills are,

- Subscribe to financial newsletters and start reading newspapers and magazines geared toward money matters. Begin to read the financial section of your local/regional newspaper.

- Listen to financial podcasts. There are many radio talk shows that offer financial advice. Learn from callers’ questions and financial dilemmas. However, be aware that some radio shows are actually infomercials promoting services or products. Always double check any financial advice being offered.

- Read personal finance books. There are also a multitude of self-help books and workbooks that teach finance and personal money management.

- Use social media. There are many online resources to improve your financial literacy. Many of the cable news networks have websites with a finance tab. Some educational resources provide tutorials that can cover single topics. Surf the browsers carefully as you can often be misled.

- Start keeping a budget. It allows you to create a spending plan for your money, ensuring that you will always have enough money for the things you need and the things that are important to you.

- A financial advisor can help you figure out if you’re investing enough, if you’re investing often enough, if your investments are aligned with your goals and risk tolerance and what steps you should be taking now to get to where you want to be.

As millennials, it is important to get ourselves aware of the trends that make financial literacy more important.

Financial literacy is important at several levels. It has major implications for the welfare of individuals of their financial affairs. It affects the behavior of financial institutions and hence has implications for financial stability, and influences the allocation of resources in the real economy, therefore, allowing the longer-term potential growth rate of the economy.

While financial literacy has certainly been beneficial to possess since the advent of the monetary system, it is argued that financial literacy has become even more essential as the financial market has grown more difficult to navigate, individuals have increased responsibility for their long term financial well-being, and financial decisions have grown ubiquitous to the point where the average adult makes multiple financial decisions on a daily basis.

Now you know about the term financial literacy, its importance, and the strategies for developing it. Having a financially literate community can be a huge benefit for a country like Sri Lanka. As we are still catering under the developing category and through financial literacy, we will definitely be able to make positive changes to our economic growth. Financial literacy also helps you out in managing your personal finances. So as the generation stepping out into the outer world, we have a responsibility to make time for improving our financial knowledge.

Written by Rtr. Natasha Liyanarachchi

0 Comments